Champion Homes (SKY)·Q3 2026 Earnings Summary

Champion Homes Beats on EPS as Manufactured Housing Demand Holds Steady

February 4, 2026 · by Fintool AI Agent

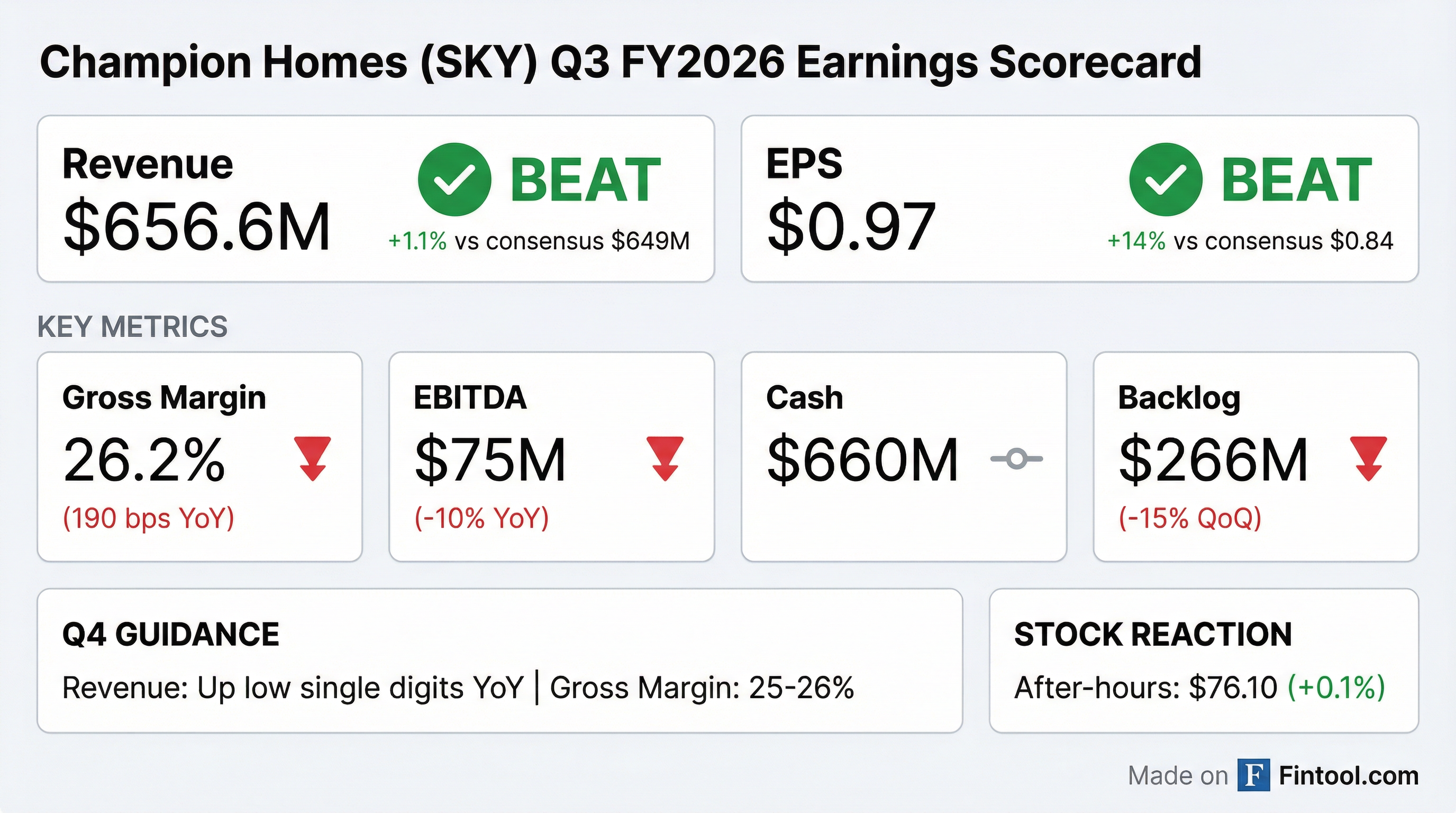

Champion Homes (SKY) reported fiscal Q3 2026 results that beat on both the top and bottom line, with EPS of $0.97 exceeding consensus by 14% despite ongoing gross margin pressure. Revenue of $656.6 million came in 1% above estimates, as the manufactured housing leader navigated a challenging macro environment with strong execution in its captive retail channel and contributions from the Iseman Homes acquisition.

The quarter marked a leadership transition with new CFO Dave McKinstry joining the company and retiring CFO Laurie Hough participating in her final earnings call.

Did Champion Homes Beat Earnings?

Yes — solid beat on EPS, modest beat on revenue.

The EPS beat was driven by higher average selling prices from a shift to multi-section homes and increased prices at company-owned retail stores, plus a lower effective tax rate (18.3% vs 21.1% YoY) from energy-efficient home tax credits.

Gross margin of 26.2% came in slightly better than management's expectations but contracted 190 basis points year-over-year due to higher manufacturing material costs and lower fixed cost absorption on reduced volumes.

What Did Management Guide?

Q4 FY2026 guidance reflects cautious optimism heading into spring selling season:

CFO Dave McKinstry noted the guidance reflects "cautious consumer sentiment, the seasonally lower winter selling period, and softer demand in certain markets and customer channels." Weather-related disruptions from recent extreme events could create additional variability.

Key drivers for Q4:

- Captive retail inventory build ahead of spring selling season (timing headwind to gross margin)

- Trade show participation (Louisville, IBS Orlando) driving higher SG&A

- Order growth carried into Q4 from Q3

What Changed From Last Quarter?

The margin story continues to be the key focus. Here's how Q3 compared to Q2:

*Values retrieved from S&P Global

Key shifts:

- Community channel softness persists — Sales to community/REIT customers declined YoY as partners moderated inventory with consumer confidence

- Captive retail strength — Company-owned retail now 38% of sales vs 35% a year ago, benefiting from Iseman acquisition integration

- Tariff impact below expectations — Came in "significantly below the 1%" management had previously guided, thanks to supplier negotiations

How Did the Stock React?

Muted reaction after a rough run into earnings.

SKY shares closed at $76.03 on February 3rd, up 1.4% on the day, and traded essentially flat at $76.10 after hours. However, the stock had already declined ~20% from mid-January highs near $95, likely pricing in housing sector concerns.

The stock is trading at roughly 10x forward earnings, well below historical averages, reflecting investor caution on housing demand trends.

Key Management Quotes

On legislative tailwinds:

"There remains a strong bipartisan focus on solving the housing crisis, and we believe that is the foundation for the Senate and the House to work together to enact meaningful legislation... We were encouraged to see the House pass the Affordable Homes Act, which reaffirms HUD as the final authority on manufactured housing standards." — Tim Larson, CEO

On the Trump Homes initiative:

"A lot of the policymakers in Washington, they've been talking about how off-site built homes, manufactured housing industry, is a core part of that solution. Because when you think about the price points that we need to get to in our country, you know, those $150,000, $200,000, $300,000 homes, that's really made possible in an off-site model." — Tim Larson, CEO

On new product strategy:

"This strategy is reflected in the Emerald Sky home we launched at the recent Louisville show. A stunning 1,600 sq ft, three-bedroom, two-bath home at a consumer retail price of approximately $185,000. When combined with land cost in each market, that places the total price for our home well below the new home ASP in the United States that's hovering around $500,000." — Tim Larson, CEO

Q&A Highlights

On the spring selling season outlook:

Analyst Phil Ng (Jefferies) asked about early reads on spring demand. CEO Larson responded: "We carried in some order growth. We mentioned in Q3, we had orders growing, and that's gonna benefit us in Q4... We certainly anticipate, hopefully, as consumers have some tax relief and other elements with rate trends, that those can be in our favor."

On community channel inventory:

Larson emphasized a calibrated approach: "What I'm encouraged by is we've been very calibrated with our community channel partners. So if they see an opportunity, we're gonna be able to move quickly versus having that kind of languished in terms of the timing of their inventory."

On gross margin outlook:

CFO McKinstry noted dynamics are expected to continue: "The dynamics underpinning the market will continue from Q3 to Q4. We don't expect any wild variables between ASPs, between input costs or mix from what we saw in Q3."

Capital Allocation

Champion continues to return capital aggressively:

Additionally, the sale of ECN Capital (Champion's 19.7% stake) to Warburg Pincus is progressing, with expected proceeds of ~CAD 189 million. The Champion Financing joint venture was extended for an additional three years as part of the transaction support.

Forward Catalysts

Near-term (Q4 FY2026):

- Spring selling season demand trends

- Weather impact on production/delivery

- International Builders' Show (Orlando) — showcasing builder-developer capabilities

Medium-term:

- Housing for the 21st Century Act progress in House

- HUD code modernization (chassis-free manufactured homes)

- ECN Capital sale closure (H1 2026) — ~$140M USD proceeds

Strategic:

- Builder-developer channel expansion (Blythe Village project launch)

- Digital investments in Dealer Portal driving independent retail leads

- Skyline Homes brand momentum — named America's Most Trusted Manufactured Home Builder for 6th consecutive year

Risks and Concerns

- Gross margin pressure — 190 bps YoY contraction with continued headwinds from material costs and lower utilization

- Community channel weakness — REIT partners moderating inventory; recovery timing uncertain

- Consumer sentiment — Management repeatedly flagged "cautious consumer sentiment" as a headwind

- Legislative timing — Housing bills remain in flux; Road to Housing Act was not included in NDAA

- Weather volatility — Recent extreme weather events creating delivery/production uncertainty

Bottom Line

Champion Homes delivered a solid quarter in a tough environment, beating estimates on both revenue and EPS while maintaining its strong capital return program. The 14% EPS beat was impressive, though driven partly by tax benefits. The more concerning trend is the continued gross margin compression (now 26.2% vs 28.1% a year ago) as material costs and lower utilization take their toll.

The setup heading into fiscal Q4 is cautiously constructive: orders are growing, captive retail is executing well, and the spring selling season could provide a lift. But with the stock down 20% heading into earnings and trading at ~10x forward EPS, investors are clearly skeptical that the affordable housing tailwinds will materialize quickly enough to offset cyclical pressures.

Key metrics to watch: Gross margin trajectory, community channel order rates, and housing legislation progress.

Related Links: